Your car tire has a nail in it.

Your child has a fever that won’t go away and you’re considering making a trip to the emergency room.

Your boss just gave you the notice that they’re downsizing. Which means they have to let you go.

What do these three have in common?

They all are emergencies that require immediate financial attention—aka emergency cash.

Sadly, many Americans don’t plan on these calamities when saving.

According to this article, 66 million Americans don’t have enough doe to pay for small, unexpected mishaps—as in they don’t have an emergency savings fund.

Emergency car repairs ($500), a trip to the emergency room ($1,000), 3-6 months of living expenses when transitioning to another job ($4,500+), you name it.

So, it’s important to create an emergency cash fund before something urgent and unplanned comes up.

Read on to learn how you can do that!

For this, we look to the three U’s: unexpected, uncompromising, and urgent.

Unexpected means these are events that you didn’t predict in the crystal ball of life.

You didn’t think your kid would break his arm during a soccer game. Or your dog would get a spider bite.

Uncompromising entails there’s no other choice. You have to pay for this event, like it or not. This usually implies there’s a security risk at stake if you don’t. In other words, it’s necessary.

You have to pay for the x-rays and doctor appointments in order for your child’s arm to heal properly.

You need to take your dog to the vet so the vet can determine how bad the bite is. And give your dog the proper medicine.

Urgent means now. You need access to that cash right away. Because the situation calls for it.

If this is your first time creating an emergency fund, start small. Aim to set aside $500-$1,000.

Once you’ve reached that, you can save up more.

It’s recommended to save up enough so you’re able to cover 3 months (up to 6 months) of your living expenses.

This is so you have enough money set aside in case you lose your job—which is one of the biggest financial emergencies.

Here are some ways to help you save emergency cash.

Whenever you break a $20, stash those 5s and 1s in the jar. You can also put loose change in there, and then later convert that into dollar bills.

This rule requires 50% of your income to go to your living expenses, 20% to your savings, and 30% to personal expenses.

Your emergency cash would be a part of that 20%. (Retirement, savings, Roth IRA, 401(k)… would be in this bracket too.)

Make sure the emergency fund is liquidated and accessible. So, a simple checking account will do.

Also, know banks don’t have a designated “Emergency Funds” account; it’s up to you to create one.

And, should you want to start investing, set up an emergency fund before doing that. Especially in regards to more volatile deals.

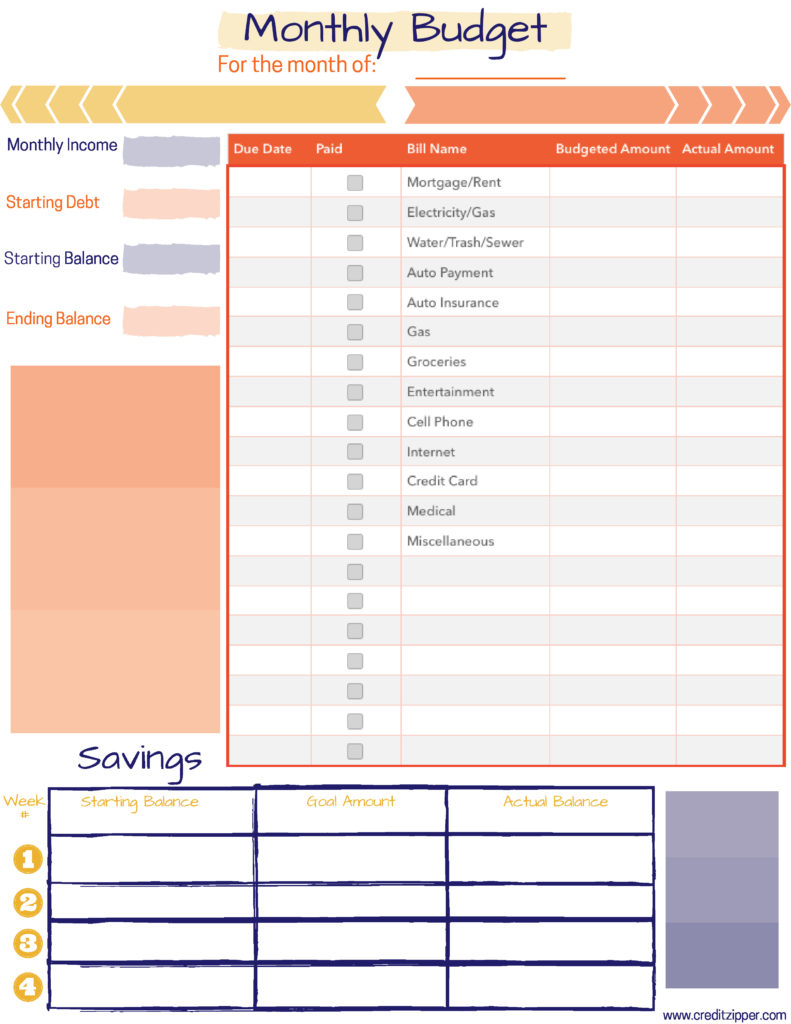

For more financial advice, check out our blog. And be sure to get our Free, Printable Monthly Budget Planner.

Today, less than half of the American population has money invested in stocks.

Today, less than half of the American population has money invested in stocks.

This isn’t a good thing – especially when you also consider that 1 out of every 3 Americans has no money saved for retirement.

Investments are a crucial way not only to make more money on what you’ve earned, but also to save and provide for yourself and your family in the future.

These days, people simply aren’t investing enough.

The reality is though, there are lots of affordable investment opportunities for every budget.

Here, we’ll show you some of the best ones, no matter how much you have to play with.

We know it can be tempting to spend that paycheck as soon as you get it!

Luckily, today there are many programs that take the work out of saving (and the temptation to spend away from you!)

Many banks today have programs that round your credit/debit card purchases up to the nearest dollar, putting the extra funds into a savings account.

Also, if you earn any “extra” income – like from a bonus or a side gig – use that as your “investment money.” That way, you’ll be able to keep up your current quality of life, and still have money to invest with!

Exchange Traded Funds are a great solution for those who can’t afford a financial advisor but still want to make smart investment decisions.

In a nutshell, ETFs are created to give you similar results to major investments on the S&P 500 without the risk and the cost of buying 500 different stocks!

Basically, they’re a package of diverse investments, meaning that it’s easy to find a solution that will help you to invest in the sectors you’re interested in.

If your employer offers a 401(k) matching plan, that’s a great way to get your feet wet when it comes to investing.

Still, we advise you to be very careful with the choices you make here.

Look at the history of your 401(k). Ask yourself: has it done better than the S&P 500?

Have you read the prospectus about the potential investments? How has past performance gone?

Finally, we advise you to also take a careful look at any fees associated with your 401(k) plan.

These are great investment opportunities for those who want financial advice on any budget!

You may even be able to get investment plans and strategies that are automatic and in line with your financial goals. You can find options for one-off trades and longer term plans.

Many of these brokers don’t require a minimum investment, meaning they’re right for any budget.

We hope this article has inspired you to start investing for your future plans, and taught you that even on a tight budget, you can still invest.

Looking for more advice about managing your money on a budget?

Want to improve your credit score?

We can help with all that and more. Spend some time on our site, and let’s achieve your financial goals together.

Are you worried that your bad credit score is going to take a toll on your personal finances? But Bad credit is not a life sentence. There are easy steps you can take to improve your score and make yourself attractive to financial lenders!

Ready to begin your credit repair journey? Read on.

Just how bad is your credit? To embark on a successful credit repair process, you need to have a good handle on your credit rating. For starters, your credit score can be any number between 300 and 850. The closer you are to 850, the higher your chances of securing a loan or any other form of commercial financial assistance.

When computing your score, credit bureaus look at the following indicators (in order of importance):

Once you know the indicators that bear the most significance, you can begin rebuilding your credit.

Clearing your existing debts is the most effective way to repair your credit. Lenders are less inclined to lend you money when they know you already have other debts you’re struggling to repay. If you’re unable to clear your debts, contact your lenders and work with them. Ask for an alternative repayment plan that suits your needs. For instance, if your business – which was your primary source of income – collapsed, you may need to provide business documents or bank account statements in support of your claim.

Is your rent often late? How about your phone, gas, water, electricity and other bills? Paying your basic bills on time shows you’re financially responsible and helps you build a positive credit history. Prompt bill payment alone may not push up your score significantly, some lenders may offer your credit if you’re showing signs of financial stability.

Entering into financial dealings with people who are financially irresponsible won’t help your credit score. For instance, if you open a joint account with a spouse who has a bad history or poor money habits, your credit score could take a hit.

Sometimes the allure of an extra credit card is too much to bear. But did you know everytime you apply for credit even if you are not approved it has an impact on your credit rating?

Any application you make for credit shows up on your credit report. The more applications you apply for, the more you affect your score.

Credit repair can be difficult. There are ways to improve your score, but don’t expect instant results. The process takes time, so you have to keep practicing the tips in this post until you hit your target score.

Do you need credit advice? Don’t hesitate to contact us.

Are you trying to save more money but never seem to find any left over at the end of the month? Or, are you wondering how to create a budget in the first place? The answer is easy: use your phone as a budget planner. Nearly half of all American families have nothing saved for retirement, and 62% of Americans have less than $1000 in total savings. Using a budget planner will help you save more, pay off debt and improve your credit rating. Here are five great options for managing your budget on the go.

Mint, created by Intuit, allows you to define a budget for each type of expense. You can also create your own custom labels. Mint will add up all your budgets compared to your income, and tell you if you have money left over.

Some handy features of the Mint budget planner are:

You can download Mint for iOS, Android or use the web browser version.

GoodBudget uses the envelope system. This means each category, like groceries and rent, contains a set budget at the beginning of the month. The app then tracks your spending in each category, or “envelope”. It deducts your spending from the total budget, showing what you have left.

GoodBudget also:

GoodBudget is available for iOS, Android and web browsers.

Wally adds modern design to budget planning to give you daily reports of your spending on your phone. Your main dashboard shows how much money is left in your budget for the month, and how much you’ve spent over the past few days.

Notable features of Wally are:

Wally is available for iOS or Android phones.

Spendee is one of the more advanced budget planners on this list. It has premium features like the ability to separate personal and business income.

Spendee allows you to:

Spendee has free and premium versions. It’s available for iOS, Android and web browsers.

Every Dollar is unique as it doesn’t just track your spending, it teaches you how to save. The app follows Dave Ramsey’s seven steps to financial freedom. They go from saving your first $1000 to building wealth. Every Dollar shows you your progress for each of these seven financial goals.

Every Dollar also:

Every Dollar is available for iOS, Android and web browsers.

Whether you use an Excel spreadsheet or a mobile budget planner, remember to check in with your progress frequently. Struggling to get out of debt or save more? Read more of our top tips for savvy saving!

You can find anything on the internet.

You can find anything on the internet.

If you’re looking to save money, you’re looking for money saving websites that can give you helpful hints.

Whether you’re trying to find the cheapest gas prices or looking to consolidate your debt, there is a website that can help you.

To get you started, we’ve rounded up five of the best money saving websites on the internet.

Let’s face it, we’re all trying to find the cheapest gas prices.

Instead of driving around your area searching for the lowest gas prices, check out GasBuddy.com.

GasBuddy is a super easy money saving website that will save you time and money.

Simply type in your zip code, choose the type of fuel you’re looking for, and hit enter.

GasBuddy then brings up the closest gas stations. It tells you the gas station name and location, as well as the gas price.

The best part of this website is it tells you when the gas price was updated.

With this website, you’ll be up to date with the gas prices in your area.

One of the best money saving websites for coupons is the KrazyCouponLady.com.

If you’re looking for all of the hottest deals on things from groceries to makeup, this is the website you need to check out.

This is not your standard coupon clipping.

The website lists all the top coupons as well as all of the best online deals.

Krazy Coupon Lady also gives you a breakdown of how to get the best deals with your coupons. So if you’re a coupon newbie, you’ll be able to repeat the same deals with no problem.

AllConnect.com is another one of our favorite money saving websites.

With this website you can punch in your budget, zip code, and the type of utility you’re searching for and it will instantly show you the cheapest prices.

You can find bundle plans, internet, phone, and electric plans that work for your budget.

Allconnect guarantees that they will find you the cheapest price in your area.

This handy little website allows you to choose your area and find the best deals near you.

Instead of you flipping through different websites looking for deals, this website does the hard work for you.

It’s connected to other deal websites to bring all the deals up in one convenient places.

If you’re spending way too much on making meals for you and your family, check out 5DollarDinners.com.

This website gives you recipes you can make for under $5. From dinners to desserts, you’ll be able to find great recipes that won’t break your bank.

For only $5 you can subscribe to have a meal plan created for you.

Saving money can be tough.

It may be daunting to look for a place to start.

Thanks to the internet, that won’t be a problem for you.

With the great money saving websites on this list pinching pennies won’t be a problem.

Need help managing your personal finances? If you do, you’re welcome to contact us.

Saving money can seem like a daunting challenge.

Saving money can seem like a daunting challenge.

Most people don’t want to forgo their lifestyle in order to save money.

You may need to get out of a sticky financial situation or want to save for an important investment.

We’re here to show you how you can save money without changing the way you live.

Take a look around your house to find ways you can pinch pennies easily.

Here are some ways you can save money in your home:

Invest in a power strip with an on and off button to easily shut off many appliances at once.

You can also consider some cable alternatives such as much cheaper streaming devices.

Most people find themselves paying for things they never use.

One of the most common ways people waste money is on unused memberships.

Are you a member of a gym you never use? Quit donating your money to the gym and cancel your membership. You’ll save money this way.

Do you subscribe to magazines you never read? Go ahead and cancel those as well.

You’ll notice these small changes make a huge difference in your bank account.

In 2012 Americans spent on average $151 a week on groceries.

That’s quite a bit of money, especially if you’re trying to stick to a budget.

In order to save money on groceries, you don’t necessarily need to start eating packaged noodles and PB&J sandwiches.

Some ways you can cut grocery costs:

In order to save money, you have to cut some corners.

But that doesn’t mean you have to sacrifice your lifestyle while doing so.

Making small changes in your life will help you save money.

If you need help saving money or getting out of debt, don’t hesitate to contact us.

Download Your Monthly Budget Planner Here: Free Monthly Budget Planner Printable

In order to stay on top of your finances, budgeting is the magic word. It’ll give you a clear understanding of what your financial situation looks like. It can also help you reach future financial goals and experience financial freedom.

Gather the total amount of your after-tax income each month. Don’t forget to include any side gigs, supplemental jobs and other sources of recurring income. If you’re married, you need to do this with your spouse because both partners need to know what’s coming in. When you count every dollar that comes in, you’ll have a better idea of what your financial situation really looks like.

Take a look at every dollar that leaves your account and where it’s going. Remember the standard bills you need to cover such as rent/mortgage and groceries. Count the bi-monthly and annual irregular bills. You don’t want to forget any standing payment obligation.

Now that you can see what’s coming in and what’s going out, it’s time to create a budget. Subtract your expenses from your total income. This will show you how much you have left for other purposes. If you’d like to place more money in your emergency fund or save for that upcoming vacation next year, you have the power to decide what goes and stays in the budget. After crunching the numbers, you need to arrive at a zero balance. If there’s more money left over or not enough to go around, you’ll need to make some readjustments. Every dollar needs an assignment.

In order to maintain a budget, you’ll need to track your spending throughout the month. Consider downloading an app that can help you keep track of what you’re spending and let you know when it’s time to slow down.

This task might seem a little foreign in the beginning, but after a couple months, most people admit that they get the hang of a budget and enjoy keeping it.

We live in a dynamic economic environment and staying straight as well as narrow when it comes to your own personal finances can definitely feel like a struggle at certain moments. Impulse buys, piling monthly bills, recreational activities, as well as unexpected costs, can quickly become overwhelming and relying on a quick loan might seem like a good idea. Even though you don’t see it at the moment, you will quickly appreciate how much more beneficial leading a debt-free life truly is. Here are 10 healthy habits that you can create in order to keep going in the right direction.

Almost every single resource is going to point you towards maintaining a serious monthly or yearly budget and sticking to it. That’s great as it’s pushing you towards becoming much more responsible towards your finances. However, your life should define your budget, not the other way around. By planning for a few steps ahead of time, you would be capable of making an actionable budget based on your life, not the other way around.

Not using credit cards is great if you can afford it. However, they also provide us with certain freedom of handling emergency situations. However, you should only charge as much as you can properly afford to repay at the end of the month. That’s the golden rule of thumb that you must absolutely follow.

This is something particularly reasonable and very beneficial. Instead of just throwing away cash for whatever you feel like eating, spend the money reasonably. Understand what’s on sale during this particular season and if you like it – go for it. Of course, you shouldn’t base your diet around sales, but it doesn’t hurt to spend your money with care.

There are quite a lot of online service providers where you can find a range of discount coupons. Lozo.com is fantastic for groceries. Ebates.com is a great resource for everyday shopping to not only get coupons but also rebates through their platform. In fact, if you play your cards right, you might get a discount on almost every single product that you buy, including restaurant dinners or a night at the cinema.

The more you postpone your bills, the more late fees you will have to pay. Organize your income and spending in a way to designate a certain day of the month during which you clear your current bills.

As we mentioned above, you need to have a sound financial plan for your future goals as well. It’s important to know where you are headed and what are you saving for. It’s good to have money in the bank as long as you have a designation for it. Saving aimlessly is doing you no good, especially if you are compromising on your life to do so.

This is particularly critical. You need to ensure that you are well aware how your money is spent. Ideally, review your finances at the end of each month. See what you spent and what you can maybe spare. Map out the things that you can do without and make sure to avoid them for the future.

This is also something of huge importance. You need to treat your savings as if they were just another monthly bill. This will make you feel responsible for it and as such, you would prioritize.

Choose to purchase items you absolutely love, not just like. Consider having a rule of thumb that you cannot purchase the item upon first seeing it. Leave the store and go home and after 2 days if you still really want it, then purchase it. This is going to push you away from unnecessary impulse buys.

While this is an easy way to becoming debt free, it isn’t always as simple as it sounds because often it means taking on more work. However, if you choose to take on side jobs you love, then you will end up earning more money, being fulfilled, and spending less money because your time is now allocated to productivity rather than shopping. There are quite a few different things which can generate extra income. UBER, for instance, is a great start if you have a nice car and healthy driving record. There is also a ton of freelance work on the Internet that you can handle as well from websites like www.Upwork.com.

Creating healthy financial habits will bring you more freedom in the long-term and living a debt free life is full of amazing rewards but it takes discipline.

Not only does being in debt cost you extra money in interest payments, it can cause emotional stress and sleepless nights. With a clear plan, determination and motivation, you can be debt-free sooner than you think. Here are 16 tips you can use to help pay off that looming debt as quickly as possible.

1. Be Devoted

You must be committed to getting out of debt. This means taking an honest, critical look at your finances and making the decision to become debt-free.

2. Budget

You must create a realistic, workable budget. You need to assign a place for every dollar of your income to scale back any overspending. List all of your debts, set up a payment schedule, and develop a system that will allow you to track your progress.

3. Check your Fixed Monthly Expenses

Monthly fixed expenses may include rent or mortgage, utilities, car payments, insurance, child care, etc.

While it can be difficult to decrease many fixed expenses, there are a couple of areas where you can try to make adjustments. Cancel your cable service or pare down to just the basics. You can also attempt to reduce your auto insurance costs by checking out quotes from competitors.

4. Rethink Your Living Situation

For many of us, our largest expense is housing. If you’re a renter, consider moving back home or with a friend or relative. If you own your home, consider taking in a tenant and putting that guest room to work for you.

5. Check your Variable Expenses

Some variable expenses may feel fixed. However, this is an area where you can easily make adjustments to free up extra cash. Variable expenses include groceries, gas, entertainment, clothing, etc.

You’ll need to temporarily scale back on dining out and other forms of entertainment. Pack your lunch daily, combine your errands to cut back on fuel use, and mend your clothing instead of buying new; apply any savings towards your debt.

6. Get a Part-Time Job

Check the newspapers and the internet job boards for part-time work. You can find extra work in an office building where you can file papers. You might be able to be a server at a restaurant and make money in tips. If you have the extra time in your schedule, a simple part-time job that requires three to four nights a week can make a dent in your debt payment.

7. Rent Out an Unused Space

If you have a room you don’t ever use in your home, convert it into a small living space for a renter. This is an excellent way to get a stream of passive income. All you’d need to do is find a good tenant who will respect the rules and pay their rent on time. If you have a basement, turn it into a basement apartment. In this case, you can still maintain your privacy and make a nice chunk of money each month.

8. Cook at Home

You need to do your best to hold on to the money you have. Instead of dining out at restaurants all time, look for copycat recipes of your favorite meals and make the meals at home. Avoid visiting fast food restaurants each night after work. That money adds up and you don’t want to wind up wasting the money on food that will only satisfy for a few hours.

9. DIY Certain Services

There are certain services that cost an arm and a leg. If you can learn to do them on your own, you’ll in much better shape. Instead of paying $40 for a mechanic to replace your car headlight bulbs, learn to do it yourself and put the money toward your debt. Mow your own lawn. The same concept applies to fixing the hem of your jacket or sewing on a missing button. These are easy fixes you don’t need to pay someone else to do.

10. Get Rid of Cable

While you might love the luxury of having 800 channels that you don’t watch, you’re probably wasting at least $40 each month on cable expenses. Instead of paying tons of money for cable, purchase internet subscriptions like Netflix and Hulu. These services offer tons of television and movie options for less than $10. Even if you purchase a few of these services, they still don’t add up to the cost of cable.

11. Use Coupons

Instead of tossing the coupons out as junk mail, take a few minutes to go through the pamphlets and find out what you can get a discount on. Challenge yourself to become a better cook by shaping your menus around what’s available in grocery coupons. Clip out the coupons that offer discounted prices on oil changes and other routine car maintenance services you’ll eventually need.

12. Stick to a Budget

Look at your money as soldiers who work for you. There should be an assignment for every dollar that comes in. When each dollar has marching orders, you’ll be able to experience more financial discipline. Remember that this is your budget so you can decide what you’d like to spend money on after the necessities get taken care of.

13. Less is More

Minimalism isn’t just a trend. It’s a long-term way of living a life of freedom. By simplifying everything in your life from the stuff you have in your home, what you purchase, the size of your home, how many cars you own, how many pair of shoes you have, and so on, you will realize how much happier you are by having less. Live by the motto, “Quality over Quantity” and you will find how much money you will save as well.

14. Keep Money Set Aside for Treats

While this doesn’t necessarily create income for you to pay off your debt, it’s important to include some sort of financial margin in your budget. All work and no play will leave you feeling hopeless and ready to give up. Whether you save $10 a week and go out to dinner and a movie at the end of the month, find ways to enjoy special indulgences to keep you motivated and on track with your debt payment goals.

15. Sell Unnecessary Items

Garage sales and flea markets are perfect opportunities to sell items you no longer use. Make sure to clean them and ensure that they’re in working condition. Additionally, you can post items online to Craistlist.org and eBay.com. There are also a lot of great online discount programs that allow you to sell clothes and other apparel to earn some extra cash. It’s time to clean out your garage and your closets and make some money.

16. Negotiate Bills

Sometimes, you can call the companies and work out a deal for a lower payment, especially for cable, phone and other similar services. Many companies want to keep your business so they will lower your bill.

17. Downsize and Downgrade Temporarily

While it may seem like a drastic fix, financial freedom is priceless. Downgrade and downsize your belongings for a period of time. Instead of leasing that nice luxury car, save a few thousand and purchase an older, used car. The money that previously went to car payments can now go to other debt payments and you’ll be able to have transportation until you get out of debt.

18. Get a Better Paying Job

Sometimes, there’s only so much you can do to save money. You might need a job that just pays better. Start looking for ways to earn more within your field. If you need to get a certification, work toward that so you can earn more on a regular basis.

19. Sell a Product

If you’ve always loved to make candles, create a candle line and sell it to family and friends. If you’re really savvy with lotions and cosmetics, produce your own homemade cosmetic line and set up a stand at local farmer’s markets. Put it at a price point that’s lucrative enough and make some extra money as a creative entrepreneur. Get creative and the there are many different products you can sell this way or on Etsy.com.

20. Freelance Your Services

Freelancing is ideal for people in fields such as graphic design, photography and writing. Wake up a few hours earlier and work on advertising your services, building a clientele and producing excellent services.

21. Telecommute

Even though the price of gas fluctuates between affordable and expensive, it’s still an expense you have. If you have the type of job that allows you to work from home, take advantage of this option and place that extra cash toward your debt.

These 16 ways are simple to understand and execute with determination and intention. As long as you consistently follow through, you’ll definitely be able to pay off your debt very quickly.

22. Raid your Savings

There are a couple schools of thought on saving while you’re in debt. Some suggest saving a small emergency fund of $1,000 while other financial professionals advise becoming debt free first.

If you have a large emergency fund it may be worth it to use a portion of your savings to pay off debt.

23. Earn More

This can seem easier said than done. But there are options aside from a part-time job. Here is a list of creative ways to earn additional income:

26 Ideas for Earning Extra Money

24. Sell Your Stuff

Start sorting through your things to determine if you have valuables that you are willing to part with. Old unworn jewelry, sports memorabilia, unused furniture – these are all items that can be easily put up for sale. Try joining a Facebook group in your city, or listing items on Craigslist, eBay, or OfferUp.

25. Check in With the Bank

Banks often have sign-up bonuses for opening new accounts. You can earn up to $300 for setting up a new checking account. There are often rules around minimum balances and requirements to set up direct deposit.

26. Renegotiate Terms with Creditors

Many people don’t realize this is an option. Your debt can be reorganized in a couple of ways. You can attempt to negotiate a lower payment than what is owed. Be aware though that with credit card accounts, for example, this often requires the card be closed. The accounts will also show on your credit reports as “settled for less than what was owed”.

If that feels too severe, you can also attempt to have your APR lowered. If your credit score is still satisfactory, you can sign up for a new card that offers an introductory 0% APR on balance transfers. This allows you to pay down the principal and cut out the interest payments.

27. Consolidate With a Personal Loan

Similar to the balance transfer option, assuming your credit is still in good standing, you can take out a loan to consolidate your debts. This works best if the interest rate on the personal loan is equal to or less than the rate you are paying on your debt.

This option will allow you to make just one payment each month. As with any borrowed money, pay more than the minimum when you can to get out of debt faster.

28. Put Your Pay Raises Towards Debt

Instead of counting increased earnings towards your monthly spend, put the extra towards your debt pay-off. Once your debt is paid off, you can put this extra money towards your savings.

29. Temporarily Cease 401(k) Contributions

This is a tough decision to make. Saving for retirement is often difficult enough and every dollar helps. But when you’re deep in debt you may need to take drastic measures. This should be a temporary fix for bringing in more money for debt pay-off. Another option is to drop your contribution down just enough to continue getting your employer match while using the rest for your debts.

30. Snowball Method

As for options for actually climbing out of debt, there are a couple schools of thought.

Once you’ve allocated the total amount you can put towards debt, you start paying off the smallest balance, paying the minimum towards all other debts. Once the smallest debt is paid in full, you “snowball” that amount into the next smallest debt. This method gives you the psychological reward of small victories as each debt is eliminated, saving your sanity.

31. Debt Avalanche Method

The debt avalanche method is popular because it makes the most financial sense. With this method, you focus on paying debt with the highest APRs first, saving yourself as much interest as possible.

32. Remain Optimistic

Surely you didn’t get into debt overnight so try to stay positive and about your debt pay-off strategy. As long as you persevere, you will reach your goal of being debt-free.

When’s the last time you had a no spend weekend?

If you’re unfamiliar with the term, a no spend weekend is exactly what it sounds like – you don’t spend any money for the entire weekend. You may be surprised how much money you can save this way. Whether it’s activities for the kids, dinners at a restaurant, movies, getting drinks or shopping sprees, those weekend expenses can accumulate quickly.

You can still have a blast without spending any money. Here’s plenty of free things you can do on your no spend weekend:

1. Family Movie Night

Watching a movie at home is often more fun than going to the theater anyway. Break out one of your favorites that you haven’t watched for a while.

2. Hiking

Not only are you getting a workout, but you’re also spending time out in nature. Hiking is a great way to relax, especially after a long week at work.

3. Go to the Park

Whether you walk around the trails or hit the swings to feel like a kid again, there’s always plenty to do at the park.

4. Read a Book

Curling up on the couch with a good book is fun and great stimulation for your mind.

5. Games

Set up a poker game with chips instead of real money, or play a board game for a free group activity.

6. Organize Your Home

You’d be amazed how much better you feel when your home is clean and organized. If you find anything you don’t need, you can also sell it or donate it.

7. Video Games

Unwind with the latest RPG, or choose a classic video game and see if you still know all the tricks.

8. Journal

Journaling, like reading, is another one of those activities that stimulates the mind. It’s also helpful to get your thoughts and feelings down on paper.

9. Learn a New Skill

What’s something that you always wished you could do? Look up tutorials and learn it.

10. Play Sports

Hit the local basketball courts and shoot around, or throw a football around with your kids.

11. Take in an Art Gallery

There are plenty of free art galleries out there. Find one and learn more about art.

12. Create a Budget

Always wanted to be better at saving money? Figure out how you can start saving every month.

13. Make a New Dish

If you find yourself making the same meals often, get a new recipe and try it out.

14. Binge Watch a Show

Sometimes it’s nice to just kick back and spend your day watching one or two seasons of a good TV show.

15. Start Learning a New Language

No matter what language you want to learn, you can find plenty of free resources and apps to get started.

16. Take a Nap

Get some extra sleep in the middle of the day and see how refreshed you feel after.

17. Volunteer

Giving back to others is always a rewarding experience.

18. Set Goals for the Future

Figure out your long-term goals, and then break them down into smaller, manageable items that you can accomplish on the way.

19. Have a Picnic

Make some sandwiches and find a comfortable place to eat outside.

20. Phone a Friend

Choose a friend or family member that you haven’t spoken to lately and give them a call.

21. Look at the Stars

Go out on a clear night and check out the constellations.

22. Give Yourself a Spa Experience at Home

Draw a bath, pour some bubbles in it and let it wash away any stress that you have.

23. Blog

If you like the idea of your thoughts being online, start writing a blog and it could turn into a money-making endeavor if you stick with it.

24. Practice Yoga

You can most likely find free yoga classes in your area, or you can bust out the yoga mat and practice poses at home.

25. Explore Your City

Pick out a neighborhood that you haven’t seen before and go take a walk around.

26. Ride a Bike

Put on your helmet and take a ride through the city or a more rural area.

27. Work on Your Garden

Plant something new or just tend to the plants that you already have. It’s highly rewarding and therapeutic.

28. Listen to a Podcast

Choose a podcast on a subject that interests you and give it a listen. You will likely learn something new!

29. Bake

Make yourself or a deserving someone some cookies, cupcakes or anything else that sounds yummy.

30. Go Camping in Your Yard

If you have the supplies, spend an evening sleeping in a tent under the stars.

31. Draw

Pick out something you want to draw or just put pencil to paper and go with the flow.

32. Dance

Invite some friends over, hook up your speakers and have a dance party.

33. Cuddle Up on the Couch

Turn off your phones and spend an evening with that special someone.

34. Have a Garage Sale

Make some money on your no spend weekend by selling those old items that you never use anymore.

35. Relax with a Cup of Coffee

Make your favorite coffee, or froth some milk and have a nice latte.

36. Take Pictures

Go outside and see what kind of shots you can get, or hang out with friends and take a few selfies.

37. Go Fish

Spend a day out on the lake and see if you can catch yourself dinner for next week.

38. Go to a Community Festival

Get to know your neighbors and see what kind of fun events your community has to offer.

39. Redesign Your Room

Look on Pinterest for ideas and then change up your bedroom.

40. Play Music

Take out your guitar, harmonica or whatever instrument you have and see what you can do.

41. Visit Family

Spend an afternoon or evening hanging out with your family.

You don’t need to spend a dime to enjoy yourself. Try having a no spend weekend with a few of the items on this list.