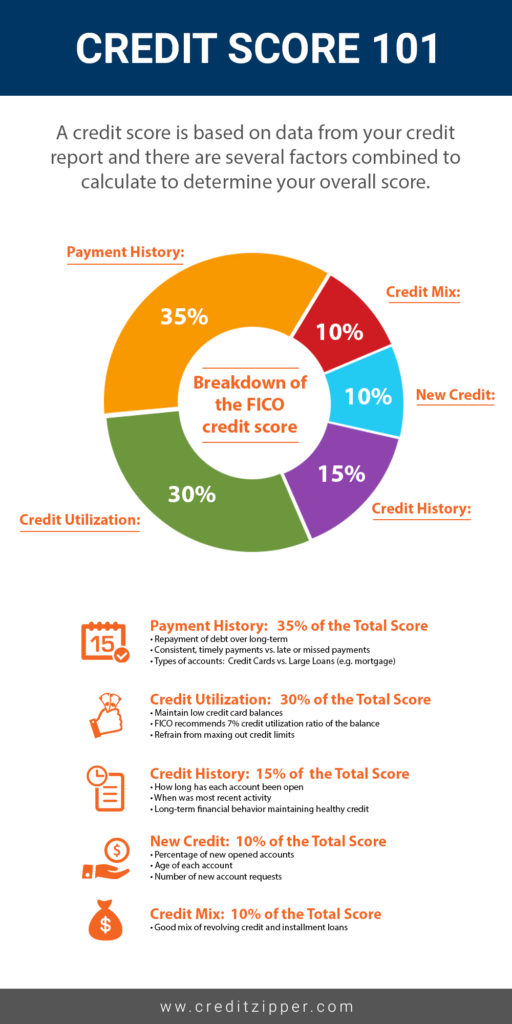

First, it is important to understand what exactly goes into calculating your credit score. The graph below shows the breakdown of what impacts your score.

There is probably no one in the world who would object to knowing tips and tricks that can improve their credit rating. A good credit score is your license to getting credit on great terms, and that’s not all. Employers often check your credit history and credit rating before offering you a job so a good score helps in many ways. However, it is not a simple task to fix a bad credit score.

This guide will outline some useful and practical tips that you can use to raise your credit score.

Doing the groundwork is very important before you start tackling the problem head on. In fact, just correcting the errors may be one of the easiest ways to a better credit score. The good thing is that you can get free credit score reports from the three bureaus once every year so you can keep track of your score at absolutely no cost. Request TransUnion, Experian and Equifax for your current credit report and carry out a detailed audit on each of them. You may want to compare them side by side to catch omissions and errors more easily.

There are several areas where errors may occur:

List out the errors you find in each of the reports. The next step is to dispute these with the specific credit bureau that has issued the report.

The higher your available credit, the better your credit score. At the same time, the lower your unpaid credit card balance, the more likely it is to increase your credit score. It makes sense to keep your balance at a minimum even if you have a high available balance and to pay back twice a month to keep your unpaid balances low when the creditors report it to the credit bureaus. These are steps to increase your credit score that may not be feasible all the time but are great tips when you need a higher credit score.

When you do this, you keep penalties and interest payments at bay while ensuring that the right account balances are reported monthly. Plus, you are in control of your credit card spending because you are paying off the balances every month.

Tend to spend too much when you have credit cards in your wallet? Well, that’s a good reason to leave them at home when you are shopping but not a good reason for cutting them up and throwing them away.

What you should understand is that credit cards give you revolving debt – the kind that changes depending on your spending and repayments. When you have paid off the balance on a long standing credit card, you bring down your debt to credit ratio. You also show that you have a long credit history with one single creditor. This is viewed as a positive when calculating your credit rating.

Either use these cards for small scale expenses and pay them off in a timely manner or lock them away with the credit limit intact.

By the same logic, keeping old debts that you have paid on time is a great idea. They show that you are a financially reliable person and a good credit risk. Keep them for as long as possible on your report.

For those whom have really bad credit scores, getting a new credit card may be a big nightmare. However, it’s not an impossible task. Secured cards are prepaid cards, which means that you can only get as much credit as you have prepaid. For the creditor, this is a no- risk card because you have already paid and this is why they will not bother you for a great credit score or good credit history to give you one of these.

Now, how do these help with improving your credit score? Well, these are still a line of credit irrespective of how they play out to the creditor and you. Using them responsibly, not missing any payments and maintaining an excellent credit history with them for a long period are all ways to boost your credit score overall.

These credit cards from your local gas station are not only easier to get, but they can also help you establish a great credit history quickly and easily. These cards from Shell, ExxonMobil and BO Fuel are a helpful way to establish a healthy credit history. The one thing not to be overlooked is paying off the balances fully on a monthly basis without fail.

The payment history part of your credit report has a big role to play in your overall score. Late payments lower your credit score. Even one late payment can leave a lasting impact while also incurring penalties or interest hikes. A good way to keep control over this aspect is to only run up bills that you can easily pay off each month. This also indicates that you are paying in full month after month which is something that creditors love to see and something that impacts your credit score most favorably.

What if you already have a number of unpaid bills accumulated? The strategy is to start paying them down starting with the oldest because these have the most impact on your credit score. With bills that are heading towards collections, take immediate action, call the creditor and tell them you are paying them off NOW so that you can avoid the collection proceedings that will reflect on your report.

When you are trying to improve your credit score, you need to pay attention to your Debt-to-Credit ratio. This is also referred to as credit utilization. Basically, if you have several credit cards all maxed out, you do not present a good risk. Avoid this at all costs. Before you do that, you need to find out your Credit Utilization Rate. There is a simple formula for this:

The idea is for you to keep your utilization rate at a maximum of 30% (preferably much lower) of your total available credit. The lower this rate, the better your credit score. So, how do you get your rate to be lower? First, you lower your interest rates. Next, focus on your existing cards. Increase the credit limits on them while you pay down the balances. Start with the higher interest cards first. Also, do not run up new balances.

While you are at it, also make sure that your utilization rate ON EACH OF YOUR CARDS is at the right level. You might want to transfer balances from high utilization cards to low utilization cards to get maximum benefit. Usually balance transfer is free.

Let’s digress a bit here and tell you another great tip for improving credit scores quickly: enhancing your credit limit. When you have a great run with a credit line, meaning that you have paid off on time every time, your creditor will be happy to give you more credit. Usually this is automatic but you can ask for this increase, too. The advantage of doing this is that your available credit shoots up and your dues seem smaller in comparison. If you are denied the increases, you know that the creditor does not consider you a good risk and you have an opportunity to find out what the problem is right away.

A pay- for- deletion negotiation can help immensely in keeping the really drastic entries out of your credit report. Write to your creditors whose accounts are in collection proceedings and confirm that you will pay them in full. In turn, ask them to report the balance as being ‘paid as agreed’ to the credit bureaus. Once you get their written agreement to this, you can pay them off.

You can always depend on your family for help and support and that’s especially true if you have family members who have great credit. What you need to do is become an authorized user for their account and their good credit standing reflects on you as well. This is also a great way to get a good credit rating when you have little to no credit history. Of course, you need the family member’s authorization to do this, and they should have held the specific account for a minimum of two years. If these conditions are satisfied, you can write to their creditor and get a written agreement outlining how much of the account you can use and what repayments you are liable for. Needless to say, you are using this to improve your credit score so run up only small bills that you can easily manage to pay off well in time.

If you have been paying off your bill on time consistently and you just miss a few payments, you may be able to get a good faith adjustment done to remove the missed payment entries from your credit reports. The creditor bases his decision on how risk-free his relationships with you have been so far. To get a good faith adjustment done, you need to write to the creditor explaining the reasons for the late or missed payments and pointing out that it has never happened before. You also have to promise that it will not happen again. If you have valid reasons, like you had an accident or a storm destroyed your house or a burglary caused all of the papers to be lost, then the creditor is likely to view your request favorably. Getting such late payments removed kicks up your score a few notches.

When it comes to charge off accounts, here is an important point to know. Accounts that are 2 years old or even older than that do NOT impact your credit rating. However, the ones that are new do have a massive impact on your score. Look for those accounts that have been charged-off within the last 2 years and focus on paying them off first. Start with the largest amount and work your way down to the smallest to get the maximum benefit. When they are paid off, they disappear from your reports over time.

When a third party, like a lender, looks at your credit report to review and determine your credit standing, they are making a hard inquiry. Hard inquiries are made on your credit score when you apply for mortgage loans, auto loans, lines of credit and apartment rentals. The problem is that with each such inquiry, your score actually declines slightly and the impact remains for a couple of years. Hard inquiries may also include identity verification.

As opposed to these hard inquiries, when background checks are done on you or when you request your own credit report, there is no damage done to your score. These are called ‘soft inquiries’.

Did you know that it is not just taking out loans but also just shopping for them that can impact your credit score? The number of new credit lines you open within a short time frame makes a massive impact on your score. The higher the number, the lower your score will be. So what can you do about it? Simple. When you are shopping for loans, remember that your lenders may be posting hard inquiries for your credit report and this tends to push down your score. First, do all the comparing you want, but only apply to those loans that you are serious about taking. Second, the credit bureaus tend to bunch inquiries arising from a similar credit line (say mortgage) together and take it as one single inquiry. Get smart by doing your entire loan applying quickly within a two- week period so that they all get merged into one single inquiry with a minimal impact on your score.

These are loans that are given to build credit and you pay them back on installment like any other loan. Typically, these are short-term loans that last from 6 to 18 months. These are reported to all three credit bureaus so you can boost your credit rating by simply taking these loans and making sure you pay them on time.

Want to know how it works? It’s simple, actually. The credit union opens a savings account for you. You determine the size of your loan beforehand. When you remit payments, the amount is credited into this savings account. At the time of your last payment, the savings account is yours to use. You can start these loans at small sums such as $500, so they are great loans to fund small purchases while letting you build your credit history and score.

Errors in your credit do not only mean there are inaccurate entries. Often, there is key information that is missing, too. When one of your accounts is omitted from the report, this can skew your credit score. If the account is one where you have favorable history and a great record of on-time payments, the positive impact it can have on your credit score will definitely be missed. When you discover such omissions, write to the credit bureau immediately and make sure they include this account. You will need to send documentation to show that the account belongs to you and that it is active. For example, you can send bills you pay towards this account on a recurring basis.

The thing is that many billers are not required to report info to the credit bureaus. Some examples of such billers are your cell phone service provider, internet provider, utilities, insurance provider, medical bills etc.

You can, however, ‘kindly ask’ them to if you have great payment records with them. The addition of this info can give your credit score a massive boost because you have a new credit line on your credit report plus your excellent credit history with them will reflect on your overall credit risk status!

When your debt is in collection, you can explain what happened with a short note that is attached to your credit report. If you had a real emergency or a very valid reason for the unpaid debt, here is your chance to give some perspective to whomever is looking at your report. While Transunion and Experian let you add multiple statements, Equifax is more stringent and allows only one statement in a report.

If you are renting your home, your monthly rental payment is likely to be your biggest payment. Showing that you are making these on time, every time is a big plus for your credit rating. Experian not only factors these payments when calculating your score, they also tell you how they do it right here.

Your landlord may not report the payment to the credit bureau but that need not stop you from getting the benefit of paying on time. Simply pay your rent online using a service like RentTrack and you can easily report your timely payments without a hitch.

It is not an easy task to improve your credit score yourself and often, you find the going so tedious you give up. That’s a good reason to call in the pros and get them to do the job for you. Credit repair companies have experts with the right kind of knowledge and experience to catch errors and omissions, dispute them until resolution and more until your credit score is healthier!

We give you comprehensive reviews of the best credit repair firms here so that you can make a judicious decision. Look at the features and services and pick one that matches your needs. In our opinion, Sky Blue Credit tops the list of best credit repair companies, at present.

Leave a Reply